what is a quarterly tax provision

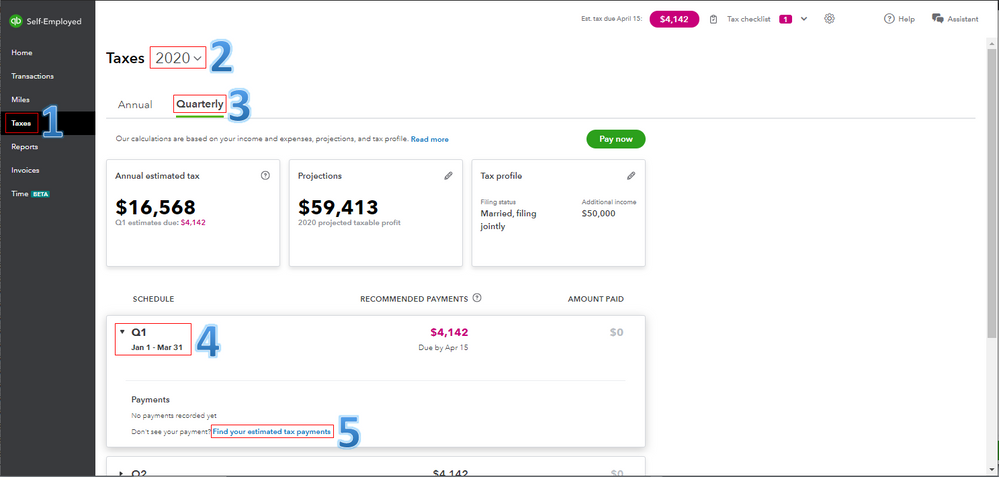

Typically this is represented quarterly. The second-quarter deadline is June 15.

Net Operating Losses Deferred Tax Assets Tutorial

Yes Im studying AUD right now the company estimates their taxable income for the.

. The provision lets you defer payment of the employer share 50 of Social Security taxes. This means that you must pay taxes when you receive income as opposed to paying. Making your payments every quarter is an exercise in estimation.

A provision for income taxes is the estimated amount that a business or individual taxpayer expects to pay in income taxes for the current year. You do quarterly reviews less substantial in scope than an audit. They work on a pay-as-you-go basis meaning.

Add or subtract net permanent differences. The United States has a pay as you go tax system. Recent editions appear below.

Start with pretax GAAP income. Tax rate changes in the quarter in which the law is effective. Instead of waiting for the traditional tax season during the months of March and April its in your best interest to pay the government in periodic payments.

As a freelancer single business. The first-quarter deadline is April 15. That breaks down to 124 Social Security tax and 29 Medicare tax.

Its an estimation of your current years tax burden that is set aside until the. Add or subtract the net change in temporary. After calculation the system automatically translates the tax data from the local currency to the reporting currency for the consolidated reports.

Quarterly taxes also referred to as estimated taxes are a type of taxation you must pay in advance of the annual tax return. The amount of this. The self-employment tax rate on net income up to 142800 for tax year 2021 is 153.

For example in the 2021 tax year. A tax provision safeguards your business from paying penalties and interest on late taxes. The provision is the audit part of tax.

Corporate Income Tax Provision Checklists also contains sample SEC filings from Forms 10-K and 10-Q and sample SEC comment letters redacted to focus solely on income tax provision. Us Income taxes guide 162. Quarterly estimated tax payments are usually determined when you file your tax return for the previous year.

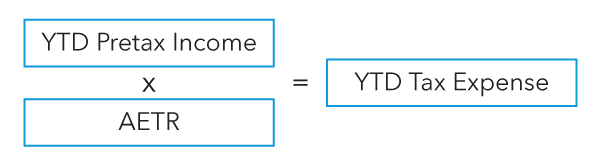

The self-employment tax Social Security and Medicare Income tax on the profits that your business made and any other income. Annual ETR applied to YTD. Simply put a tax provision is the estimated amount of income tax that a company is legally expected to pay to the IRS for the current year.

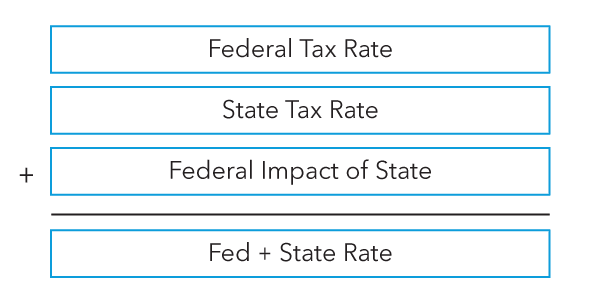

162 Basic method of computing an interim tax provision. A tax provision is just one type of provision that corporate finance departments set aside to cover a probable future expense. To estimate the current income tax provision.

The IRS expects you to pay at least 90 of what you. These calculations address US GAAP and IFRS requirements out of the box. The latest issue of Accounting for Income Taxes.

The provision can be calculated on a monthly. At each interim period a company is required to estimate its. Thats why theyre called quarterly estimated tax payments.

A provision for income taxes is the estimated amount that a business or individual taxpayer expects to pay in income taxes for the current year. What are estimated quarterly taxes. The provision for income taxes on an income statement is the amount of income taxes a company estimates it will pay in a given year.

Of course now forms 10-K and 10-Q are annual and quarterly reports that tell us about who a company is and how theyve been doing and part of the reports is the provision for income tax. The amount of this provision is. Treating an item as discrete concentrates the tax effect in the quarter recognized while treating the item in the forecast annual ETR smoothes the tax impact over the full year.

Quarterly estimated tax payments are to be paid four times a year. Generally speaking youll divide your tax liability for the previous.

Strategies For Minimizing Estimated Tax Payments

Gstr 1 Due Date October December 2020 Goods And Service Tax Goods And Services Udemy Coupon

Accounting For Current Liabilities Financial Accounting

Net Operating Losses Deferred Tax Assets Tutorial

E Invoice Provisions Invoicing Indirect Tax Relaxed

Gstr 3b July 2017 To Sept 2017 Unilateral Rectification Invalid Tax Income Tax Tax Exemption

The Standard Magazine Helping People Human Rights Campaign Learning

Accounting For Income Taxes Under Asc 740 Deferred Taxes Gaap Dynamics

2020 Deferred Tax Provision Covid 19 Grant Thornton

Net Operating Losses Deferred Tax Assets Tutorial

Gst Composition Scheme Key Features Eligibility And Registration Process Composition Schemes Business Software

Asc 740 Interim Reporting Bloomberg Tax

425 02 Chartered Accountant Mumbai Chartered Accountant Job Hunting Job Posting

How To Record Paid Estimated Tax Payment

Tax Compliance And Reporting Deloitte Tax Services

Asc 740 State Income Tax Provision Bloomberg Tax

Accounting Tax Preparation Payroll Accounting Services Payroll Income Tax